Legislation on the move: The President signs the Upstream Petroleum Resources Development Act

At a glance

- The Upstream Petroleum Resources Development Bill (now the Upstream Petroleum Resources Development Act 23 of 2024) (Act) was finally assented to by the President on 25 October 2024 and published in the Government Gazette on 29 October 2024.

- Importantly, the Act only comes into effect on a date fixed by the President by further proclamation in the Government Gazette.

- The Act brings about separation of the regulatory frameworks governing the petroleum exploration and production sector and the mining sector in South Africa

The Act can be accessed here.

The presidential assent comes after the completion of the parliamentary process which commenced in July 2021. Importantly, the Act only comes into effect on a date fixed by the President by further proclamation in the Government Gazette. We anticipate that this proclamation will likely be made after the new regulations (“Petroleum Regulations”) are published by the Minister of Mineral and Petroleum Resources (Minister). The Petroleum Regulations, once published, will be subject to a public consultation period.

The Act brings about separation of the regulatory frameworks governing the petroleum exploration and production sector and the mining sector in South Africa. Megan Rodgers, Head of our Oil & Gas Sector, says that the signing of the Act comes at a time when a clear legislative framework and stable investment conditions are crucial. A resilient energy sector requires a diverse energy mix and this includes development of our oil and gas in a sustainable manner in order to reduce dependence on any one source of energy, achieve energy security and address energy poverty in South Africa. The creation of a dedicated legislative and regulatory regime governing upstream oil and gas exploration and production is something which many of our counterparts have taken up long ago, we are simply catching up with the curve.

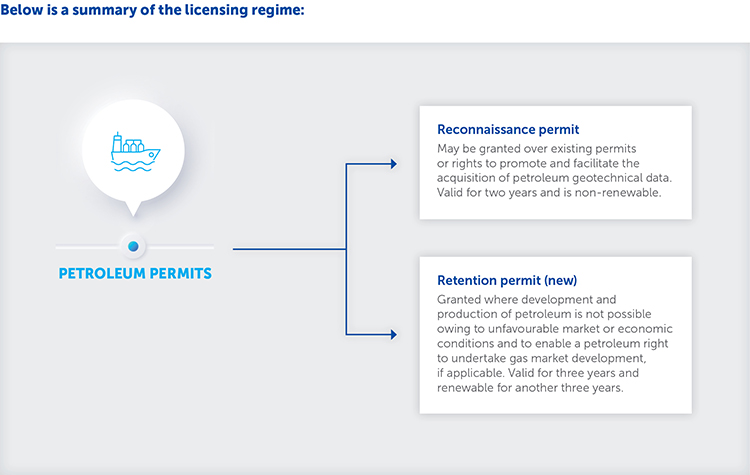

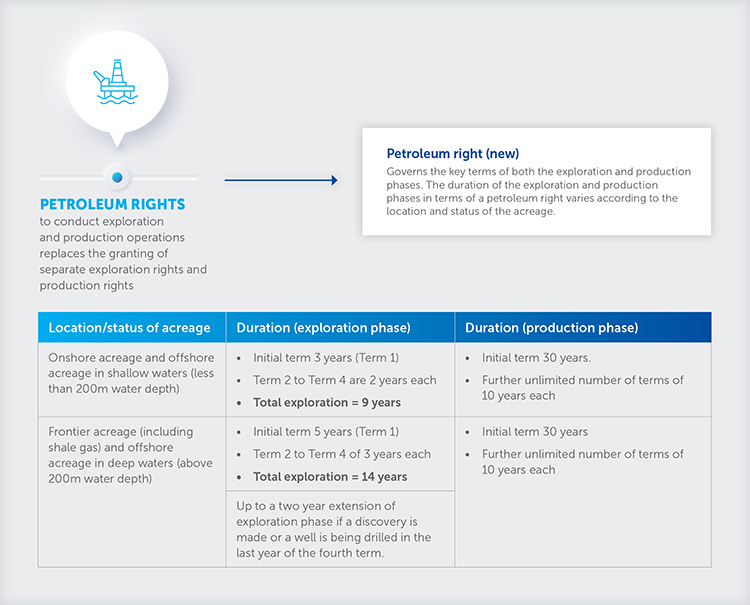

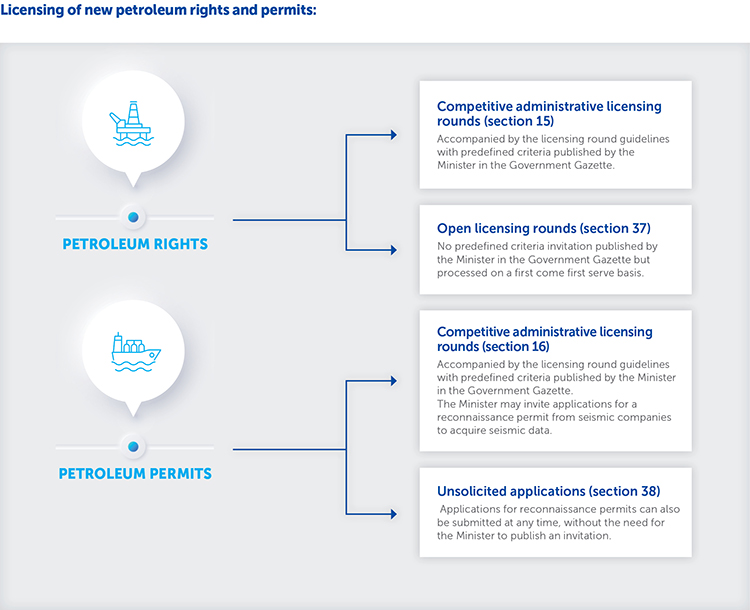

To recap on the changes to the licensing regime, technical co-operation permits will no longer be granted once the Act comes into effect. Separate exploration rights and production rights will also no longer be granted. Instead, the Act introduces the petroleum right, which will govern both the exploration and production phase.

Transitional arrangements

The transitional arrangements of the Act may be summarised as follows:

- Pending applications for rights and permits, submitted before the Act comes into effect, must be finalised under the Mineral and Petroleum Resources Development Act 28 of 2002 (MPRDA) and any pending applications for the conversion of technical co-operation permits to exploration rights or exploration rights to production rights remain in force until the right has been granted or refused. Technical co-operation permits in force, before the Act comes into effect, will remain in force until their expiry and a holder has an exclusive right to apply for petroleum right in respect of the permit area but they must apply for the petroleum right before the expiry of the technical co-operation permit.

- An exploration right granted under the MPRDA will remain in force, but the exploration right holder must apply for conversion to a petroleum right prior to the expiry of the existing term of the exploration right. The exploration right holder also has the exclusive right to convert the exploration right into a petroleum right in the exploration or production phase before the expiry of the right. If the exploration right is in the third renewal period when the Act comes into effect, the holder must apply for conversion to a petroleum right for the production phase before the expiry of the third renewal period.

- A production right granted in terms of the MPRDA and which is in force immediately before the Act takes effect or after the Act takes effect will continue in force for a maximum period of five years or until the date of its expiry, whichever is earlier. A holder of a production right under the MPRDA must apply for conversion before the expiry the five year period

The state carry and participation

The State Petroleum Company, in terms of section 34 of the Act and as identified in the South African National Petroleum Company Bill, is entitled to a 20% carried interest in the exploration and production phases. This section states that the State Petroleum Company is entitled to full participation in joint operations and to a corresponding percentage of voting rights under the joint operating agreement. We anticipate that reference to the word ‘’full’’ means that during the carry period the State Petroleum Company will have voting rights under the joint operating agreement. Notably a black economic empowerment (BEE) participant will not necessarily be required to carry the state nor will it be required to dilute its participating interest (PI) for purposes of state participation.

The state carry is repayable. Holders of a petroleum right will be entitled to recover 50% of the state’s proportionate share of exploration costs and 100% of production costs from the state’s proportionate share of productional revenue. All cost recovery rules will be prescribed in the Petroleum Regulations to be published, and to the extent necessary, further amplified in the terms and conditions of the petroleum right.

BEE participation

Section 2(d) of the Act provides that one of the objects of the Act is to substantially and meaningfully expand opportunities for Black persons to enter into and actively participate in the upstream petroleum sector. The Act gives effect to this object through the inclusion of two forms of participation contained in sections 31 to 33.

Section 31 BEE participation

The definition of Black persons includes Africans, Coloureds and Indians of South African birth or decent and includes juristic entities where 51% of the issued share capital of such juristic entity is owned by Black persons. This means that Black persons must hold 51% of the shares in the company in order to qualify as a BEE participant for purposes of section 31.

Section 31 of the Act requires that every petroleum right must have a BEE participant holding a minimum 10% undivided PI in the petroleum right. The 10% PI held by a BEE participant is a working interest (as opposed to a carried interest).

A section 31 BEE participant may dispose of up to 5% of its 10% PI for purposes of raising capital. This disposal will be subject to a right of first refusal in favour of the state. The right of first refusal is a new addition to section 31 of the Act. The disposal contemplated above will not trigger a new requirement to augment the BEE participation to 10%.

In terms of section 31(4), (i) holders of a right granted under the MPRDA who convert to a petroleum right and do not have a BEE participant or who do not have BEE participation provisions grandfathered in their existing exploration/production right terms and conditions or (ii) an applicant for a petroleum right who is unable to comply with the required BEE participation interest may apply to the Petroleum Agency for an extension to comply with section 31 which extension will not exceed two years.

Section 32 BEE participation

Section 32 empowers the Minister to reserve blocks for 100% Black owned entities. These blocks will be awarded through competitive licensing rounds to companies that meet the ownership criteria.

A section 32 BEE participant may dispose of up to 70% of its 100% PI for purposes of raising capital. This disposal will not be subject to a right of first refusal in favour of the state.

Once empowered always empowered

Section 33 of the Act entrenches the “once empowered always empowered” principle by providing that when a BEE participant exits a petroleum right, the empowerment credentials for that specific petroleum right must be recognised for the duration of the petroleum right but subject to the following conditions:

- the BEE participant must have held undivided participating interest for a minimum period of one third of the duration of the initial term of the production phase of a petroleum right (“minimum period”), or a lesser period if at least 50% of the net value has vested in Black persons prior to the minimum period;

- an agreement detailing exit mechanisms and Black persons’ financial obligations is submitted to the Petroleum Agency; and

- the recognition of empowerment credentials may not be claimed or recognised for other petroleum rights or future petroleum right applications.

In our view these conditions would benefit from clarification particularly, clarification on what “50% of the net value” entails. We hope to see clarification of this in the Petroleum Regulations.

Treasury matters

All references to production bonus and petroleum rent tax have been removed from the Act and the term “royalties” has been defined as “royalties payable to the state in terms of an act of Parliament”. Fiscal matters fall within the mandate of the Minister of Finance/National Treasury. On 17 December 2021 National Treasury issued a tax policy discussion paper on “What is the most appropriate tax regime for the oil and gas industry?” The discussion paper set out certain key proposals on the taxation of upstream oil and gas activities, including a flat-rate royalty of 5% to be levied on the gross sales of oil and gas companies which is a significant deviation from the current royalty regime that imposes a royalty rate based on profitability. As yet, there are no firm updates available post the publication of this tax policy discussion paper.

Other notable provisions

Other notable provisions include:

- A prescribed application fee in respect of applications for a transfer of interest will be introduced in the Petroleum Regulations.

- Section 86 requires that all joint operating agreements (JOAs) and any amendments thereto must be submitted to the Petroleum Agency for approval and may only be rejected if the terms and conditions are in conflict with the Act. JOAs are traditionally not public documents and may in certain instances reflect commercial information relevant to the private parties thereto and, while we recognise that in certain jurisdictions disclosure of the JOA to the regulatory authority is required, this remains atypical when measured against general industry standards.

- The validity period of a petroleum period/right commences on the date the petroleum period/right is notarially executed. If there are court proceedings instituted before or during the period of validity of a reconnaissance permit or petroleum right, the period of validity shall be suspended until the finalisation of those court proceedings.

- An applicant for a petroleum permit/right is required to conduct consultations with the owner, lawful occupier in terms of the land in question and any affected party. The Petroleum Agency must attend the consultation process to ensure the process is transparent, fair and meaningful. A consultation report must then be submitted within 60 days from the date of acceptance of the application for a permit or petroleum right.

Concluding remarks

The oil and gas industry is capital-intensive it requires substantial financial investment to explore, develop and produce oil and gas. The oil and gas resources sector in South Africa and the continent cannot mature without foreign direct investment and the interplay between legislation and investor confidence can either drive or stagnate growth and investment. The Act currently does not provide the full playbook to such investor and to be fair, it cannot purport to do so. We hope to see the full playbook unfold once the Petroleum Regulations are published by the Minister. Added to this should be the design of a comprehensive investment policy by National Treasury that attracts and incentivises the foreign direct investment needed to develop these natural resources and reduce dependence on any one source of energy, achieve energy security, and address energy poverty.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe