Strengthening ties: Unpacking the Kenya-Singapore 2024 double taxation agreement

At a glance

- On 23 September 2024, Kenya and Singapore signed a new double taxation agreement (DTA), marking a significant step towards further enhancing cross-border trade and investment between the two countries.

- This agreement is set to replace the existing DTA from 2018.

- By defining tax treatment on income from business activities between the two nations, the DTA aims to eliminate double taxation and address tax evasion and avoidance, providing clarity for businesses and promoting bilateral trade.

A year later, on 23 September 2024, Kenya and Singapore signed a new double taxation agreement (DTA) in New York, marking a significant step towards further enhancing cross-border trade and investment between the two countries. This agreement, signed by Singapore’s Foreign Minister Dr Vivian Balakrishnan and Kenya’s Prime Cabinet Secretary and Foreign Minister Dr Musalia Mudavadi, is set to replace the existing DTA from 2018. By defining tax treatment on income from business activities between the two nations, the DTA aims to eliminate double taxation and address tax evasion and avoidance, providing clarity for businesses and promoting bilateral trade.

Next steps in the approval process

Following the signing of the Kenya-Singapore DTA, the agreement will proceed through Kenya’s formal ratification process. Initially, the DTA requires Cabinet approval, after which it will be tabled in the National Assembly. During this phase, the National Assembly will review the DTA, with input from the public.

Once Parliament grants final approval, Kenya will notify Singapore, and the DTA will enter into force upon reciprocal ratification, formally incorporating the DTA into Kenyan law under Article 2(6) of the Constitution of Kenya, 2010. The Cabinet Secretary for National Treasury will also publish a notice in the Kenya Gazette, indicating that the DTA shall have effect in relation to income tax in Kenya. Pursuant to the Statutory Instruments Act, 2013, this legal notice should be tabled before the National Assembly within seven sitting days of its publication in the Kenya Gazette.

Past experiences, such as the 2019 High Court nullification of the Kenya-Mauritius DTA due to procedural issues following a constitutional petition challenging its legality, emphasise the importance of compliance at every stage. Additionally, the experience with the Kenya-Netherlands DTA – signed in July 2015 but later withdrawn by the Netherlands in May 2021 after Kenya indicated a stalled ratification process due to concerns with certain provisions – underscores that signing does not guarantee implementation, and that final ratification depends on mutual confidence that the treaty terms are beneficial and meet legislative and public standards in both countries.

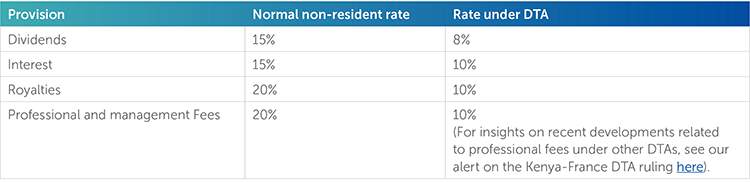

Key provisions of the Kenya-Singapore DTA

Looking forward

The ratification of the new DTA could open avenues for trade and investment between Kenya and Singapore. This is because, once fully ratified, this DTA creates a more favorable environment for businesses operating across both markets.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe