Reclassification of certain health supplements in the import duty space

At a glance

- The South African Revenue Service (SARS) has decided to reclassify various health supplements that were previously categorised under tariff heading (TH) 21.06. into TH30.04.

- 06 provides for miscellaneous edible preparations and is subject to a rate of 20% import duty, while TH30.04 pertains to pharmaceuticals and attracts a duty free rate.

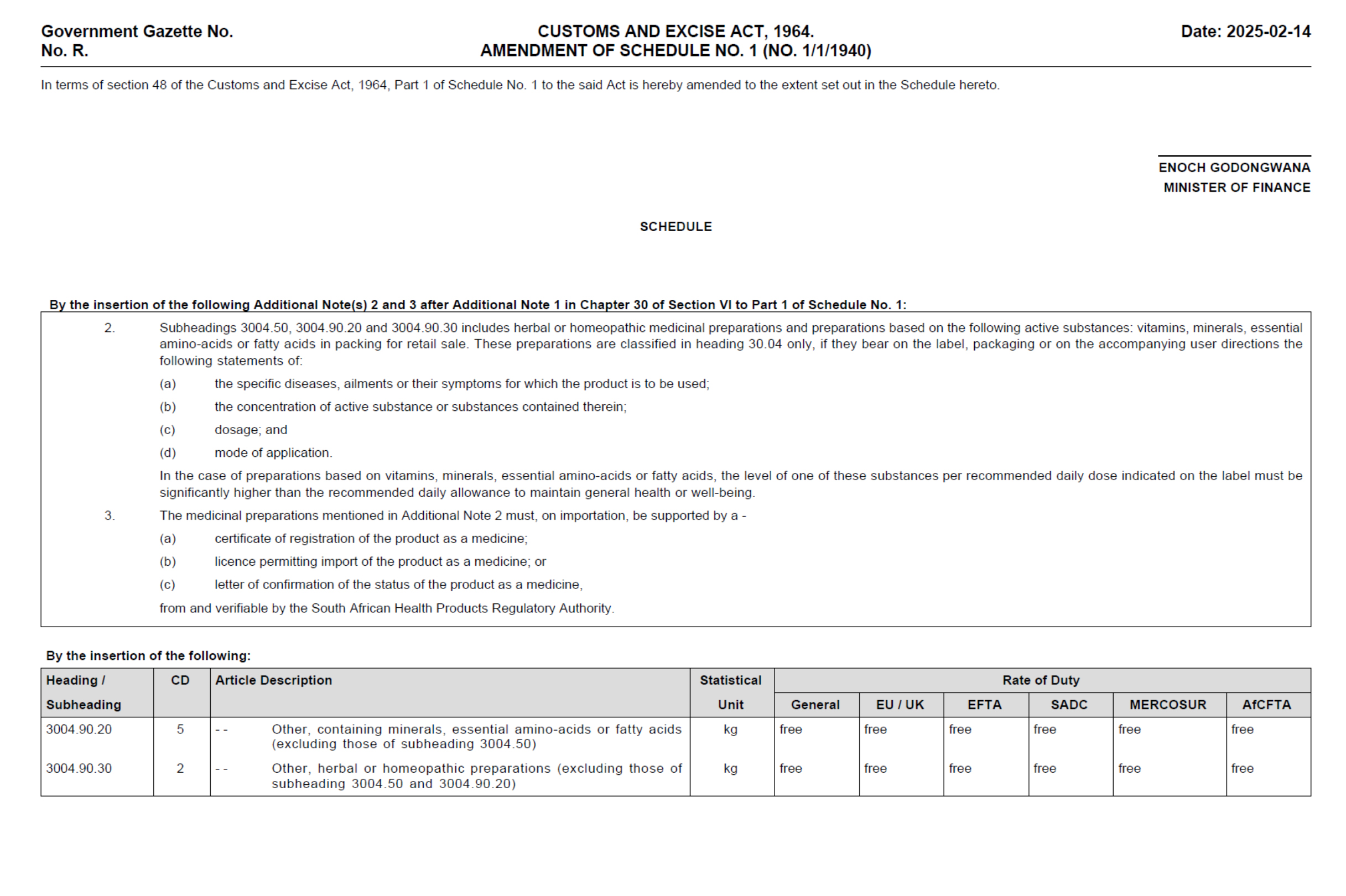

In the interim, SARS has amended TH30.04 to provide as follows:

What does this mean in practice?

Pharmaceutical companies that have imported health supplements now have the recourse to potentially have their health supplements reclassified under TH30.04, where applicable, and potentially apply for refunds of customs duties and value-added tax from SARS for a retrospective period of two years from the date of a favourable tariff determination from SARS.

Who to contact?

Pharmaceutical companies that are interested in discussing this potentially rewarding exercise may contact:

Petr Erasmus [Director] – Petr.Erasmus@cdhlegal.com / 082 576 526Savera Singh [Associate] – Savera.Singh@cdhlegal.com / 067 07 7929

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe