Recent amendments to Kenya’s tax laws: Implications and impact

The amendments aim to redefine key areas like income tax, value-added tax (VAT) and excise duty. They also introduce new rules to streamline tax compliance and administration. This alert breaks down what these changes mean for you and explores how they might impact your daily life, your business and Kenya’s broader economic future.

TAX LAWS (AMENDMENT) ACT, 2024

Income Tax Act

Definition of donation

The Act introduces a definition of “donation” that includes a benefit in money in any form, a promissory note, or a benefit in kind conferred on a person without any consideration, including grants. This amendment complements the recently released Income Tax (Charitable Organisations and Donations Exemption) Rules, 2024 which set out the necessary criteria that charitable organisations must meet to qualify for tax exemption on their income, as well as providing guidelines for donors to claim deductions for their contributions.

Expanded definition of royalties

The Act introduces an expanded definition of the term “royalty.” The act defines it to now include payments received as consideration for the right to use any software, proprietary or off-the-shelf, whether in the form of license, development, training, maintenance or support fees. The proposed definition seeks to classify all software-related payments as “royalties” and subject them to withholding tax (WHT). Previously, certain software-related payments, such as license payments made to software providers through distribution and end-user licence agreements, were not subject to WHT in Kenya on the principle that they did not confer any intellectual property (IP) rights in the software to the payers.

This practice, though contested by the Kenya Revenue Authority (KRA), is in line with the High Court’s recent judgment in Seven Seas Technologies Limited v Commissioner of Domestic Taxes, Income Tax Appeal 8 of 2017, as well as international best practices.

This is a shift from international best practices in the taxation of software payments, as captured under Article 12 of the Organisation for Economic Co-operation and Development’s (OECD) Model Tax Convention, which generally requires that such payments should only be subject to WHT if they are made as consideration for rights to the software’s underlying IP rights.

We note that the proposal would also go against the practice in the region, with both Uganda and Tanzania not including software in their respective tax laws’ definitions of “royalty.”

Introduction of significant economic presence tax

The Act has introduced the significant economic presence (SEP) tax, which is meant to replace the digital service tax (DST). SEP tax will be payable by non-resident persons deriving or accruing income from Kenya from the provision of services over the digital marketplace. A non-resident will be considered to have a significant economic presence if the user of the digital service is located in Kenya. The effective rate of SEP tax is 3% of the gross turnover earned by the non-resident, being 30% of the deemed taxable profit. The taxable profit of the non-resident person shall be deemed to be 10% of the gross turnover.

The due date for accounting for SEP tax is the same as for VAT, that is, the twentieth day of the following month.

Certain forms of income are exempted from SEP tax, such as:

- Income of non-resident providing digital services through a permanent establishment in Kenya.

- Income subject to WHT by dint of section 10 of the Income Tax Act (ITA).

- Income of a non-resident person providing digital services to an airline in which the Government of Kenya has at least a 45% shareholding.

- Non-resident person with an annual turnover of less than KES 5 million.

- Income derived from the business of transmitting messages by cable, radio, optical fibre, television broadcasting, Very Small Aperture Terminal, internet, satellite or by any other similar method of communication.

We anticipate that this will increase the overall tax liability for non-resident providers, impacting their profitability and pricing strategies, which could lead to higher costs for consumers using these digital services. We await the envisaged regulations under the Act to see how they will impact the implementation of SEP tax in Kenya.

Taxing digital platforms

The Act amends section 10 of the ITA to classify payments made through digital market platforms – covering digital content monetisation, property, and services – as income earned in Kenya. This applies to both resident and non-resident platform operators, bringing such operators into the tax net.

Furthermore, under the ITA, a “digital marketplace” is described as an online or electronic platform that enables individuals to sell goods, offer services or transfer property to others. Previously, the ITA lacked a definition for the term “platform.” However, the Act now defines a “platform” as a digital platform or website that facilitates the exchange of a short-term engagement, freelance or provision of a service, between a service provider, who is an independent contractor or freelancer, and a client or customer.

It is worth noting that the bill initially categorised all payments made or facilitated through a digital marketplace or platform for digital content monetisation, services, property or goods as taxable income. However, the Act has now excluded payments related to “goods” from this provision. As a result, WHT no longer applies to payments for goods supplied on digital platforms. Owners or operators of digital marketplaces or platforms must determine the purpose of each payment to ensure that WHT is not applied to payments for goods.

Introduction of minimum top-up tax

The Act has introduced minimum top-up tax to apply to covered persons (these are resident person(s) or non-resident persons with a permanent establishment in Kenya who are members of a multinational group with a consolidated annual turnover of EUR 750 million at the parent entity level). The tax is payable where the combined effective rate of the covered person for a year of income is less than 15%. The combined effective rate is the sum of all the adjusted covered taxes divided by the sum of all the net income or loss for the year of income multiplied by 100.

“Adjusted covered taxes” refers to taxes recorded in the financial accounts of a constituent entity for the income, profits or share of the income or profits of a constituent entity where the constituent entity owns an interest and includes taxes on distributed profits and deemed profit distributions under the ITA subject to such adjustments as may be prescribed.

The amount payable is the difference between 15% of the net income or loss for the year of income of a covered person, and the combined effective rate for the year of income multiplied by the excess profit for the covered person.

However, several persons are exempt from this tax, including:

- public entities not engaged in business;

- persons whose income is exempt under paragraph 10 of the First Schedule to the ITA;

- pension funds and assets of that pension fund;

- a real estate investment vehicle that is an ultimate parent entity;

- non-operating investment holding companies;

- an investment fund that is an ultimate parent entity;

- a sovereign wealth fund; or

- an intergovernmental or supranational organisation including a wholly owned agency or organ of the intergovernmental or supranational organisation.

This is a move for Kenya to comply with the Global Anti-Base Erosion (GloBE) rules under the OECD/G20 BEPS Project, and in particular, Pillar 2 of the 2-Pillar Solution under BEPS Action 1, designed to ensure that multinational entities pay a minimum amount of tax at 15% with respect to income arising in each of the jurisdictions where they operate. Some countries, including Australia, have implemented a minimum tax.

Increased tax-free limit for meals, non-cash benefits and pension

The Act has amended section 5 of the ITA to increase the threshold for tax exemption for meals that an employer can offer employees either from a canteen or cafeteria operated or established by the employer or a third party, from KES 48,000 to KES 60,000. Further, it has increased the tax allowable value of non-cash benefit from KES 36,000 to KES 60,000. Additionally, it has increased the tax allowable pension contribution from KES 240,000 to KES 360,000.

This proposal means that employees will have more tax-free benefits, which increases their disposable income, while employers can now offer more competitive benefit packages, making it easier to attract and retain talent without increasing direct salaries.

Increase in personal tax reliefs

Section 15 of the ITA is amended to increase the allowable deductions from an employee’s taxable income. These include the employee deductions made to the affordable housing levy, contributions made to the Social Health Insurance Fund and contributions to a post-retirement medical fund up to KES 15,000.

Increase in mortgage interest deduction

The Act has increased the limit for deductible interest payments for a loan taken towards the purchase or improvement of a residential building to KES 360,000 per year. We hope this will incentivise people to take mortgages for their homes.

Income tax exemption of pension benefits from registered pension providers

The Act amends the First Schedule of the ITA to exempt disbursements from registered pension funds, registered provident funds, registered individual retirement funds, public pension schemes and the National Social Security Fund from income tax when a person reaches the age of retirement. Currently, section 16 of the ITA provides that these pension benefits are not allowable deductions from taxable income and the First Schedule only exempts monthly pension payments to a person who is 65 years of age.

Moreover, the exemption will also apply to:

- Payment of gratuity or other allowances paid under a public pension scheme.

- Payment of a retirement annuity.

- Early withdrawals from the fund, that is, before one reaches retirement age because of an illness or after 20 years from the date of registration as a member of the fund.

- The change is welcome as it will allow people to access their pension free of tax, subject to meeting the requirements under the Act.

WHT on payment from the supply of goods to a public entity and digital marketplace payments

The Act has amended the Third Schedule to introduce WHT in respect of a payment made by a public entity for the supply of goods at the rate of 5% for non-residents and 0,5% for residents.

The introduction of WHT on payments for goods supplied to public entities has several implications. For instance, suppliers now face increased compliance requirements, including record-keeping and filing returns, which may add administrative burdens. The deductions could impact cash flow, especially for small businesses, as payments will be made net of tax. The differentiated rates of 0,5% for residents and 5% for non-residents may influence supplier competitiveness, potentially favouring local businesses. This change could boost government revenue while encouraging public entities to procure locally. However, suppliers may adjust prices to account for the tax, potentially increasing costs for public projects. Furthermore, non-resident suppliers may also face additional complexities in claiming tax relief under international treaties. Finally, public entities may need to train their offices on accounting for withholding tax on supply of goods as there are harsh penalties for failing to do so.

WHT on digital marketplace payments

The Act introduces WHT in respect of income deemed to have accrued in or been derived from a digital marketplace at the rate of 20% for non-residents and 5% for residents. The WHT adds another layer of complexity for players in the digital market space, which has been heavily targeted for tax in the recent years.

Payments for the sale of scrap to be subject to withholding tax

The Act has amended section 35 of the ITA to introduce WHT on the sale of scrap. The withholding tax rate is 1,5% of the gross amount for both resident and non-resident payments.

This aims to broaden the tax base, enhance compliance and capture revenue from transactions that may have been underreported or untaxed, thus ensuring tax collection at the point of payment and reducing evasion while standardising tax treatment across all parties. The measure is expected to boost government revenue and improve compliance, though it increases administrative burdens for businesses.

It is worth noting that the Act does not define what scrap includes. Therefore, the absence of a clear definition may create room for tax disputes. Furthermore, this introduction was not among the proposals contained in the Tax Laws (Amendment) Bill, 2024 (Bill).

Capital gains tax for entities certified by the Nairobi International Financial Centre Authority as having met specified criteria

Investors who invest at least KES 3 billion in at least one entity registered or incorporated in Kenya within two years will enjoy a reduced capital gains tax of 5% (instead of 15%) upon the transfer of their shares where the transfer occurs within five years after the investment. Such investments must, however, be certified by the Nairobi International Financial Centre Authority.

Income of a registered family trust to be taxable

The Act has amended paragraph 57 of the ITA’s First Schedule by deleting the words “income or” in the paragraph. The paragraph previously provided for income tax exemption on “The income or principal sum of a registered family trust”. The amendment means that only the principal sum of a registered family trust shall be exempt and not its income.

This change could affect the tax liability for trusts, as any income generated from the principal sum will now be subject to taxation. Additionally, this may impact the financial planning and sustainability of family trusts, as beneficiaries may face higher tax obligations on income distributed or accumulated within the trust. Furthermore, the amendment could lead to increased administrative responsibilities for trustees to accurately report and manage taxable income.

Value-added Tax Act

Clarification on the time of supply for exported goods

Section 12 of the VAT Act has been amended to clarify that the time of supply for exported goods shall be when the certificate of export or such other equivalent export document is issued by customs.

Suppliers (exporters of goods) will be expected to have a certificate of export or such other equivalent export document before declaration of the supply in the VAT return. While this may be challenging to implement from a timing perspective, given that information relating to tax invoices generated by eTIMS is transmitted in near real time for declaration in VAT returns, this will simplify the process of refund application verification. The Act, however, does not define the equivalent export document, and this may be problematic where it is disputed whether goods have been exported or not.

Credit for input tax against output tax

Section 17 is amended by the Act to remove the threshold for the VAT apportionment formula for taxpayers making 90% of zero-rated supply. The remaining provisions introduce a more general requirement to apportion input tax based on actual use. Businesses can fully deduct VAT only on expenses directly related to taxable supplies, with no deduction allowed for those used solely for non-taxable purposes. Mixed-use expenses now require allocation without an automatic threshold for full credit. Without the prior thresholds allowing full or zero deductions based on use ratios, taxpayers may face more limited input VAT deductions if they have significant mixed-use expenses. This may increase their VAT payable as fewer input credits are allowable on partially exempt activities.

Taxpayers with a higher ratio of exempt sales to taxable sales stand to benefit from this change, as it allows them to claim input tax related to their taxable supplies. Conversely, those whose taxable sales exceed their exempt sales may face a disadvantage, as they will need to limit their input tax deductions using the input apportionment formula.

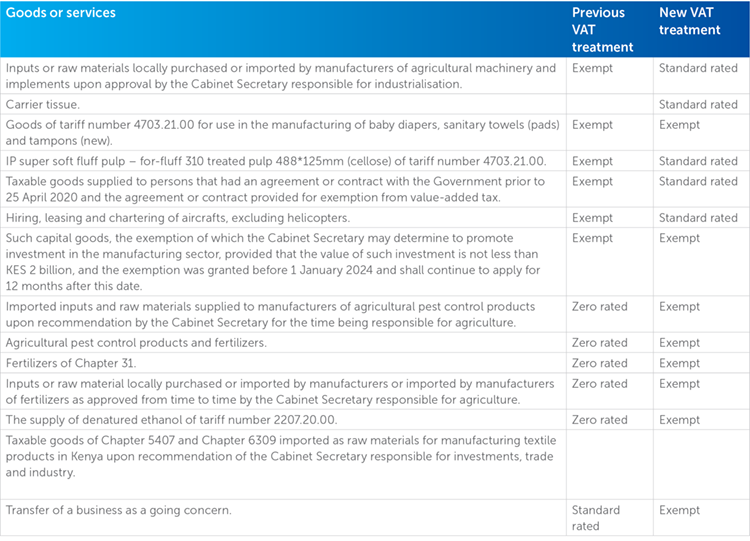

Change in VAT status for certain goods and services

The Act has reclassified certain goods and services to be either taxable, exempt, or zero-rated, as seen in the table below.

Application of East African Community Customs Management Act to exports

Section 65 of the VAT Act shall be amended to expand the application of the East African Customs and Management Act for VAT purposes to exported goods.

Excise Duty Act

Imposition of excise duty on services provided by non-residents through a digital platform

The Act has introduced excise duty on services offered by non-residents through digital platforms. Non-resident providers of digital services shall be required to collect and remit excise duty. They could do so through a simplified method to be provided by the KRA, or through tax agents. The rate has, however, not been specified.

Previously, the Excise Duty Act imposed excise duty only on excisable services offered from a supplier’s place of business in Kenya. This recent amendment broadens this scope to include excisable services delivered by non-resident entities via digital platforms. This means that non-resident providers of services such as money transfers, betting and gaming, and internet data will now be required to account for excise duty on services offered through digital platforms. The amendment seeks to create parity between resident and non-resident providers in terms of excise duty obligations while also boosting government revenue.

Excise duty remission on spirit made from agricultural products grown in Kenya

The amendment by the Act means that spirits made from specific local agricultural products (excluding barley) will be included in the list of alcoholic beverages for which the Cabinet Secretary can waive or reduce excise duty. The aim is to promote the production of local spirits using domestic agricultural products, potentially benefiting local farmers and producers.

Extended period for payment of excise duty by manufacturers of alcoholic beverages

Licensed manufacturers of alcoholic beverages will now remit excise duty by the fifth day of the following month from the previous 24 hours after the removal of goods from the stockroom.

The revised timeline will lead to more efficient administrative practices, as manufacturers can streamline their processes to account for duty payments in line with their monthly financial reporting cycles. The move is a welcome relief to affected taxpayers, who have been pre-financing payment of the excise duty.

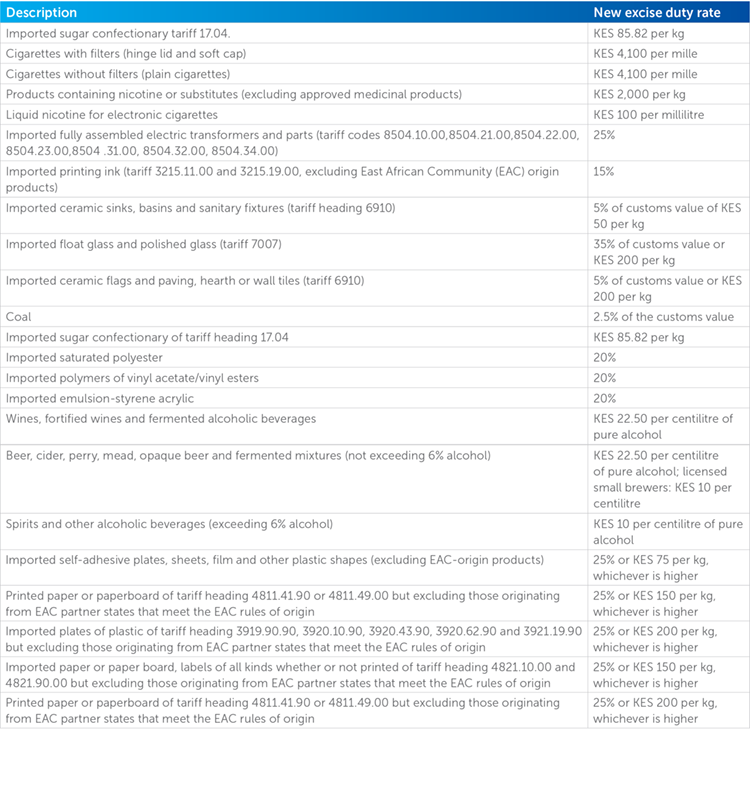

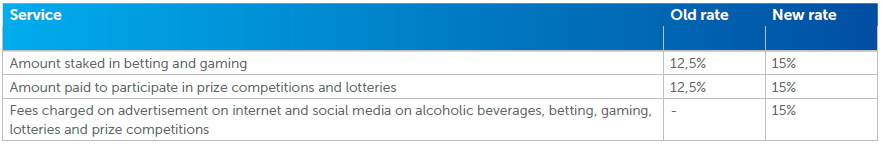

Changes in excise duty rates

The Act has also increased the excise duty rates for the following services/activities:

The Miscellaneous Fees and Levies Act (Cap. 496c)

Increased railway development levy

The Act has increased the railway development levy (RDL) from 1,5% to 2%.

The rise in the RDL means that importers will now face a higher cost when bringing goods into the country. This increase will likely be incorporated into the overall cost of imported products, which may have a cascading effect on local industries that rely on these imports, potentially leading to increased production costs.

THE TAX PROCEDURES (AMENDMENT) ACT, 2024

Below are some of the key proposed amendments to the Tax Procedures (Amendment) Act, 2024 (TPA).

Electronic tax invoices

The Act has amended section 23A of the TPA to specifically outline the information that should be included in an electronic tax invoice (ETR) as follows:

- the words “TAX INVOICE”;

- the name, address, and personal identification number (PIN) of the supplier;

- the name, address and PIN, if any, of the purchaser;

- the serial number of the tax invoice;

- the date and time when the tax invoice was issued and the date and time when the supply was made, if it is different from the date the tax invoice was issued;

- the description of the supply, including quantity of the goods or the type of services;

- the details of any discount allowed at the time of supply;

- the consideration for the supply;

- the tax rate charged and total tax amount of tax charged; and

- any other prescribed information.

The requirements aim to standardise ETRs and ensure consistency in the country. It is noteworthy that the requirements mirror those proposed in the Finance Act, 2024, in the repealed Regulation 9 of the VAT Regulations, 2017, as well as the VAT (Electronic Tax Invoice) Regulations, 2020.

Reverse invoicing

The Act also introduces reverse invoicing provisions for small-scale businesses/farmers with turnover of less than KES 5 million. Ordinarily, it is the supplier of a taxable supply that is required to issue an invoice. The move is aimed at ensuring that purchasers assist small-scale suppliers to issue the invoices on their behalf and nudge the small-scale traders or farmers into the tax net. The tax collector will have visibility of their incomes for purposes of levying/collecting tax.

Tax amnesty extension

The Act has extended the tax amnesty programme on interest, penalties and/or fines on any unpaid amount of principal tax to 30 June 2025. The amnesty is on interest and penalties that have accrued up to 31 December 2023. It only applies to taxpayers who pay their principal tax by 30 June 2025.

The extension to 30 June 2025 is a welcome move because it gives taxpayers some more time to clear their accrued principal tax for the period in consideration in exchange for waiver of penalties and interest. We encourage taxpayers to take advantage of this incentive.

Reinstatement of the power to abandon unpaid tax due to doubt or difficulty in recovery

The Act has reinstated the provision that granted the KRA Commissioner (Commissioner) discretion to abandon tax liability where there is doubt or difficulty in recovery of the unpaid tax. Under this provision, once the Commissioner determines that unpaid tax is impossible to recover, they may abandon the tax with the Cabinet Secretary’s prior written approval. The Cabinet Secretary may also direct the Commissioner to take any action as the Cabinet Secretary may deem fit in respect of the unpaid taxes or obtain the courts’ directions in respect of the case. Finally, the Commissioner is mandated to publish a notice in the Gazette every four months indicating the names of the taxpayers, amount abandoned and the reasons for abandonment. The notice must be laid before the National Assembly promptly for their approval or annulment within 21 days from the notice.

The Act has introduced a new ground for abandonment of tax, that is, where it is in the public interest to abandon the tax. Public interest has not been defined but we hope that this provision will not be abused.

Withholding VAT agents

The Act that withholding VAT will not be applicable to registered manufacturers whose value of investment on 31 December 2024 is at least KES 2 billion. In addition, the Act imposes a penalty of 10% for WHT VAT agents who fail to withhold or remit the withheld VAT. WHT VAT agents will need to update internal controls, such as improved tracking systems, regular audits and staff training to manage the risk of the enhanced penalties.

Offset of refund of overpaid tax

The amendment of section 47 of the TPA will allow a taxpayer who overpays their taxes to either request to offset the overpaid amount against future tax liability including instalment taxes and input VAT. The expanded method of utilising overpaid tax against any tax head provides clarity on how taxpayers can utilise their overpaid tax.

The amendment also clarifies that a taxpayer can offset overpaid tax in one tax head (such as income tax) against a different tax head (such as VAT).

Integration of electronic tax systems

The amendment grants the Commissioner powers to give notices to businesses with over KES 5 million in annual turnover to connect their electronic tax systems to the KRA’s itax system to submit electronic documents and detailed transaction data. The notice will be for up to a maximum of one year and failure to comply can result in a monthly fine of up to KES 100,000.

The Act partly cures the issues that were raised during the public hearings on the Bill by barring the KRA from requiring a taxpayer to integrate systems or share data relating to trade secrets and personal data.

Extended time for objections and appeals

The amendment excludes weekends and public holidays when computing time for lodging objections or appeals to the Tax Appeal Tribunal, High Court or Court of Appeal. This is a welcome amendment as it increases the number of days for a taxpayer to lodge an objection against an assessment or appeal an objection decision.

Non-filing penalty for export processing zone enterprises

The Act introduces a penalty of KES 20,000 per month for export processing zone enterprises that fail to submit tax returns as required under the ITA. The penalty has been reduced from KES 2,000 per day, which was very punitive.

Plan to tax remote workers

The Act now mandates employees working remotely outside Kenya for an employer in Kenya to register for tax in Kenya and ultimately pay tax in Kenya. The move is part of Kenya’s plan to ensure that all employment income derived from Kenya is taxed in Kenya.

Noteworthy differences between the Bill and the Act

Payments for the sale of scrap to be subject to withholding tax

The Act has amended section 35 of the ITA by introducing payments related to the sale of scrap within the scope of WHT, with a rate of 1,5% applied to both resident and non-resident payments. This introduction of WHT on scrap was not subject to public participation, as it was not part of the proposals in the Bill.

Definition of digital lender

In terms of excise duty, the Excise Duty Act has defined a “digital lender” under section 2 of the Excise Duty Act, 2015 (EDA) as a person holding a valid digital credit provider’s licence issued by the Central Bank of Kenya. This definition was not included in the Bill. Additionally, Part III introduces definitions for fees charged by digital lenders and small independent brewers:

Definition of fees charged digital lender

Fees charged by digital lenders include any fees, charges, or commissions related to their licensed activities, excluding interest, pre-loan interest, post-loan interest, profits, insurance premiums or commissions related to insurance activities. By clearly specifying what is included in “fees,” the law prevents lenders from disguising taxable fees as excluded charges, such as interest or insurance premiums.

The Act further defines small independent brewers as manufacturers of beer, cider, perry, mead, opaque beer, wine, fortified wines and mixtures of fermented beverages with non-alcoholic beverages, whose production does not exceed 150,000 litres per month. This definition provides regulatory clarity for both the brewers and the authorities. Furthermore, the inclusion of small independent brewers in the legislation reflects a broader strategy to support local industries and promote entrepreneurship within the alcoholic beverage sector. This is particularly important in economies where small businesses play a crucial role in job creation and innovation.

Moreover, the Bill initially sought to remove VAT exemption on certain goods, including aeroplanes and spacecraft over specific weights, as well as specially designed motor vehicles for tourist transportation. However, the Act has reverted these items to VAT-exempt status.

Similarly, the Bill proposed removing VAT exemption on services such as betting, gaming, air ticketing supplied by travel agents, entry fees into national parks and the services of tour operators (excluding in-house supplies). The Act has reinstated these services as VAT-exempt.

Provisions that were dropped in Tax Laws (Amendment) Act, 2024, and the Tax Procedures (Amendment) (No.2) Act, 2024

The Tax Prcodures Act (Amendment) Act 2024 introduced notable changes to the provisions initially outlined in the proposed bill. One such amendment was the adjustment of the threshold for reverse invoicing. While the proposed bill set this at KES 1 million, the Act increased it to KES 5 million under section 23A of the TPA. This change aims to ease compliance for smaller businesses and ensure that the reverse invoicing requirement is applied more equitably.

Another key revision was the extension of the period covered by tax amnesty. Initially, the proposed bill limited this to 31 December 2022. However, the Act extended it to 31 December 2023, as reflected in the amendment to section 37E of the TPA. This extended timeline provides taxpayers with additional opportunities to benefit from the amnesty programme and align their tax obligations.

This Act also introduced a more taxpayer-friendly timeline for refund applications for taxes other than income tax. The proposed bill allowed only six months for such applications, but the Act extended this to 12 months under section 47 of the TPA. This change acknowledges the practical challenges taxpayers face and offers a more reasonable timeframe for filing refund claims.

Finally, the penalty for failing to comply with notices for integration with eTIMS was significantly reduced. The proposed bill prescribed a penalty of KES 500,000, which the Act lowered to KES 100,000 in its amendment to section 59A of the TPA. This reduction ensures that penalties encourage compliance without imposing an excessive financial burden on businesses.

The Tax Laws (Amendment) Act dropped the proposal to levy WHT on infrastructure bonds and green bonds, initially included in the Bill, due to several key considerations. Firstly, there were concerns that imposing such a tax would discourage both local and foreign investments, as it could lead to higher borrowing costs, with investors demanding increased interest rates to offset the tax burden, thereby making these bonds less attractive. Additionally, many institutional investors already enjoy tax exemptions on bond interest earnings, meaning only a small segment of bond buyers would be affected, limiting the revenue-generating potential for the Government. Financial experts also warned that introducing WHT could distort the secondary market for infrastructure bonds, as investors might favour existing tax-exempt bonds over newly issued taxed ones, driving up demand and prices for the former while lowering yields on new issuances.

Moreover, analysts suggested that the expected revenue from the proposed WHT might not justify the potential increase in interest rates demanded by investors, potentially resulting in higher interest costs for the Government than it would collect from the tax.

In addition, this proposed bill sought to remove the capital gains tax exemption on the transfer of property to a family trust, as specified in Paragraph 58 of the First Schedule of the ITA. However, the Act retained this exemption, acknowledging the importance of preserving favourable tax treatment for such transfers, which often have significant family and estate planning implications.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe