Retirement fund lump sum benefits and severance benefits

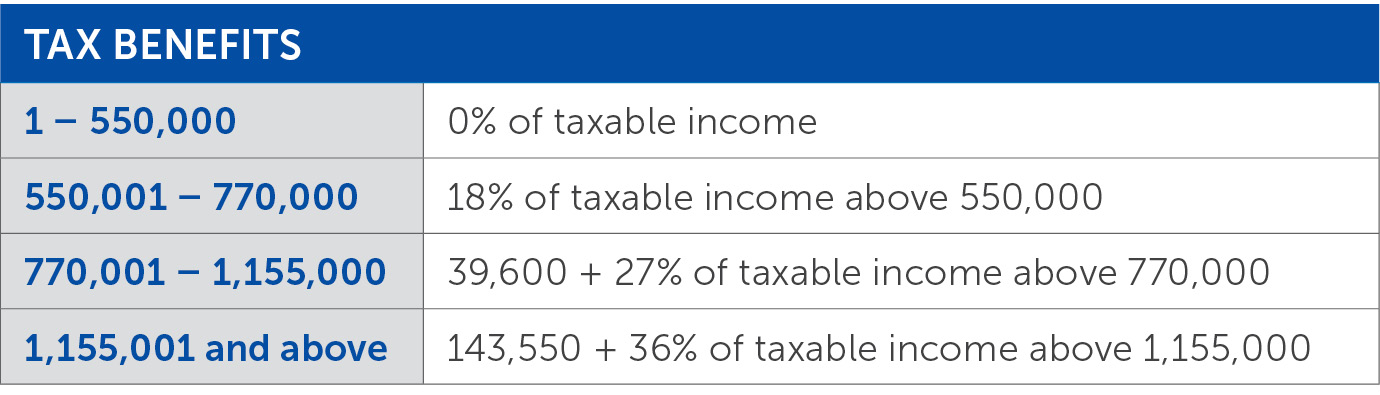

The lump sum tax benefits (including severance benefits) due to the termination of employment as a result of reaching the retirement age, sickness, accident, injury, incapacity, redundancy or termination of the employer’s trade has been amended as follows:

As part of the tax calculation on a specific lump sum benefit (retirement or severance), any amounts received, and tax paid from October 2007 in respect of retirement benefits or March 2009 in respect severance benefits will be taken into consideration. For further information and advice please contact us.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe