The Kenyan High Court delivers a judgment on the Social Health Insurance Act, 2023 and the related acts

At a glance

- The Social Health Insurance Act, 2023, the Primary Health Care Act, 2023 and the Digital Health Act, 2023 were enacted to realise the right to the highest attainable standard of healthcare services.

- The High Court held that sections 26 (5) and 27 (4) of the Social Health Insurance Act were unconstitutional to the extent that they violated the right to not be denied emergency medical treatment; section 38 was unconstitutional for violating constitutional provisions on openness, accountability and public participation in financial matters; and all three pieces of legislation were enacted without sufficient public participation.

- The National Assembly has been given an opportunity to amend the unconstitutional sections and undertake proper public participation within 120 days, failing which, the acts will be deemed null and void.

A three-judge bench in Aura v Cabinet Secretary, Ministry of Health and 11 Others [2024] eKLR on 12 July 2024 rendered judgment on the constitutionality and the enactment process of the acts. The High Court held that sections 26 (5) and 27 (4) of the Social Health Insurance Act (SHIA) were unconstitutional to the extent that they violated the right to not be denied emergency medical treatment; section 38 was unconstitutional for violating constitutional provisions on openness, accountability and public participation in financial matters; and all three pieces of legislation were enacted without sufficient public participation. The National Assembly has been given an opportunity to amend the unconstitutional sections and undertake proper public participation within 120 days, failing which, the acts will be deemed null and void.

Pertinent issues

In this alert we focus on the following key issues that were before the court:

- whether barring people from accessing emergency medical treatment under sections 26 (5) and 27 (4) of the SHIA is inconsistent with the Constitution;

- whether section 38 of the SHIA constitutes a violation of Article 201, 205 and 206 (1) of the Constitution; and

- whether there was breach of Articles 10 and 118 of the Constitution on public participation in the enactment of the three pieces of legislation.

Is barring people from accessing emergency medical treatment under sections 26 (5) and 27 (4) of the SHIA inconsistent with the Constitution?

The petitioner challenged sections 26 (5) and 27 (4) of the SHIA for being unconstitutional. He contended that the sections hinder the implementation and enjoyment of Article 43 of the Constitution, which enshrines the right to not be denied emergency medical services.

Section 26 (5) of the SHIA requires every registrable person to produce proof of registration and contribution as a precondition of dealing with or accessing public services from the national Government, county Government or national or county government entities. Section 27 (4) on the other hand provides that healthcare services can only be accessed if a person’s contributions to the Social Health Insurance Fund (SHIF) are up to date and active.

The court determined that the objectives of SHIA and sections 26 (5) and 27 (4) are aimed at bringing solidarity and equity in terms of subscription and contribution to the SHIF, and at the same time ensuring that the benefits are spread across the population in a sustainable manner. Therefore, the limitation is reasonable, justifiable and proportionate.

However, to the effect that sections 26(5) and 27(4) of SHIA have not made an exception to the right to emergency medical services, the same cannot stand the test of constitutionality. They offend Article 43 (2) of the Constitution to the extent that the precondition set out infringes on the right to access to emergency services, a right bestowed by the Constitution. Therefore, the court has given the National Assembly 120 days to amend the provisions to make sure that the right to emergency services is shielded from compliance with the preconditions.

Does section 38 of the SHIA constitute a violation of Article 201, 205 and 206 (1) of the Constitution?

The National Assembly introduced an amendment of the section and did not allow stakeholders and the public to submit their comments on the same. Initially, it provided that money that is not immediately required would be invested in a reputable bank with the advice of the Central Bank of Kenya or in government securities with the advice of the National Treasury. Currently, it reads: “All receipts, earnings and accruals to the Authority and balance of the funds at the close of each financial year shall be retained by the Authority for the purposes of the Funds.” The court held that the current wording fails the test under Article 201 (a) of the Constitution, which emphasises the need for openness, accountability and public participation in financial matters, and therefore found the section to be unconstitutional.

Was there a breach of Articles 10 and 118 of the Constitution of Kenya on public participation in the enactment of the acts?

The court held that participation of the people is a cornerstone of Kenya’s governance ethos enshrined in the Constitution. It is also the spirit of the Constitution that no decision affecting the people of Kenya should be made without a provision for recourse. Public participation must be meaningful and, if the matter is technical, it should be preceded by sensitisation. Further, the stakeholders consulted should be broad and the notice should be in legible letters. In this case, the three days’ period given for the public to submit comments for the acts was insufficient and there was no sufficient sensitisation of the public on the acts and their likely impact. Therefore, the acts fall short of the constitutional criteria for public participation.

Commentary

The court has acknowledged that the acts mark a major milestone by the Government in its efforts to ensure that all Kenyans have access to healthcare services. However, the court has affirmed the importance of sufficient public participation in the legislative process, especially with pieces of legislation that will impact many people.

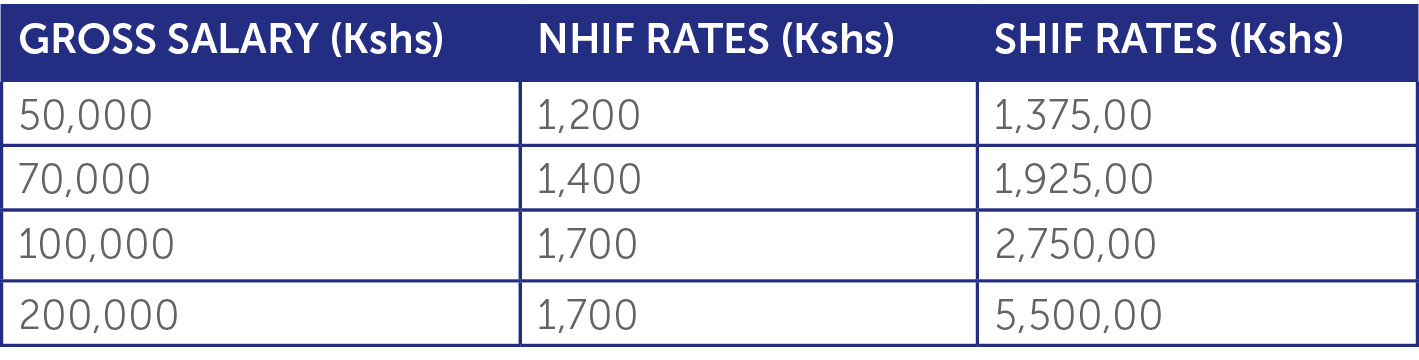

The SHIA calls for mandatory registration for all Kenyans, unlike the current National Health Insurance Fund (NHIF) which is voluntary for people under informal employment. Once the National Assembly makes the amendments as required, employers will be required to make contributions to the SHIF on the ninth day of every month, just like the current NHIF. Likewise, people who are not formally employed will make an annual payment to the SHIF. Employees will see a change on their payslips of 2,75% of their gross salary being deducted in place of the current NHIF deduction. The 2,75% of their gross salary is a bigger deduction when compared to the current NHIF, rates as illustrated below:

The Primary Health Care Act, 2023 and the Digital Health Act, 2023 provisions were not challenged, save for the lack of sufficient public participation in their enactment. The National Assembly will engage the people of Kenya, who will have the opportunity to give their views and comments.

Conclusion

The effect of the suspension of the acts for a period of 120 days is that the deductions which were to take effect beginning 1 July 2024 will await the National Assembly’s adherence to the structural interdicts issued in this decision. As it stands, employers will continue making deductions as per the current NHIF rates. Once the National Assembly effects the proposed amendments and the SHIF becomes operational, the deductible amount (2,75% of an employee’s gross salary) will form part of the taxable income. The Finance Bill, 2024 had proposed that this amount be excluded from an employee’s taxable income, but it was not passed into law.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2026 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe