NERSA’s decision on Eskom’s curtailment application pending

At a glance

- In terms of a consultation paper released by the National Energy Regulator of South Africa (NERSA) on 5 July 2024, Eskom submitted an application to NERSA on 24 May 2024 requesting approval for congestion curtailment to be treated as a constrained generation ancillary service for renewable energy resources.

- The proposed use of congestion curtailment as a mechanism to open and optimise grid capacity comes as no surprise.

- However, the technical, contractual, legal, and financial implications of congestion curtailment on a specific project will need to be assessed on a case by case basis.

A public consultation meeting was held on 22 August 2024, with NERSA’s decision on the Application still pending at the date of this publication.

By now, it is trite that constrained grid capacity is one of the most significant hurdles affecting the rate of uptake of new generation capacity in the South African energy market, especially in respect of renewable energy. Due to limited grid capacity availability in the Cape Provinces, only 1,000 MW of solar PV was awarded in April 2023 under Bid Window 6 of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP).

This market and governance failure stimulated several processes for regulatory reforms, including:

- Eskom’s introduction and application of the Interim Grid Capacity Allocation Rules (IGCARs), which have yet to be codified;

- the release of the Generation Connection Capacity Assessment 2025 Addendum (GCCA 2025 Addendum) in January 2024, proposing the implementation of a 10% curtailment on present and planned operational wind energy generation facilities to open a total of 3,470 MW of grid capacity (2,680 MW grid capacity in the Western Cape and 790 MW in the Eastern Cape); and

- Eskom’s controversial application to NERSA for preservation and/or reservation of grid capacity in favour of any project procured in terms of a public procurement process under section 34 of the Electricity Regulation Act 4 of 2006. While the application was ultimately rejected by NERSA, it evidences the ongoing, unresolved competition for very limited grid capacity.

The proposed use of congestion curtailment as a mechanism to open and optimise grid capacity therefore comes as no surprise, and industry has been eager to understand inter alia (i) timing for implementation (i.e. when the available capacity will be made available and operational plants curtailed); (ii) if the capacity that is opened up will be made available to both public and private market participants; (iii) if only future projects will be impacted; and (iv) how curtailment compensation will work, especially in respect of private market renewable energy projects for which power purchase agreements (PPAs) have already been concluded.

Timing for implementation

On timing, both the Application and Consultation Paper clarify that congestion curtailment will only be implemented from 2026 onwards when the projects that take up the 3,470 MW of grid capacity that will be available through curtailment start coming online. Considering it will be “dictated by the need to manage the reliability of the transmission system”, timing on the potential expansion of the scope of guaranteed curtailment to open grid capacity beyond what is provided for in the GCCA 2025 Addendum is unclear, thus introducing significant uncertainty into the market.

Scope of the Application

As to its scope, it is evident from the Application that congestion curtailment will include both private and public renewable energy power producers and will also apply to existing and future renewable energy projects.

Prior to publication of the Application, it was also understood that, per the GCCA 2025 Addendum, and for purposes of opening up the 3,740 MW of capacity, curtailment of any project would be limited to 10% and would apply only to wind projects and identified substations in the Western Cape and Eastern Cape. The Application and Consultation Paper, however, suggests that Eskom intends to deviate from this, providing as follows:

“Congestion curtailment conditions can occur anywhere in the country. It will occur first in the Western Cape, Northern Cape, and Eastern Cape because that is where the networks are currently constrained … But in future, as rooftop penetration increases, this phenomenon can occur anywhere in the country and the curtailment process may apply widely as dictated by the need to manage the reliability of the transmission system.”

In terms of curtailment levels, while the current planning criteria for curtailment is still limited to 10%, the Application does note that this can be altered in future.

Given its broad scope, the industry has raised concerns that the Application, if granted, will give Eskom unrestricted power to curtail regardless of renewable energy technology, initial planning criteria limits, and project location.

Allocation of capacity

It is unclear how Eskom intends to allocate capacity that is made available through congestion curtailment. In light of the rejection of its grid reservation and/or preservation application, it is understood that the “first ready, first served” principle, as entrenched in the IGCARs, will continue to apply.

Compensation

The issue of compensation for energy not delivered due to congestion curtailment was raised at the outset when curtailment was first proposed as a grid congestion management mechanism. It is of particular concern in the bilateral space, where the initial proposal was that buyers and sellers under existing corporate PPAs can be retrospectively impacted and should share equally in the losses – something that would not have been accounted for in the PPA terms, agreed tariff, or returns calculations.

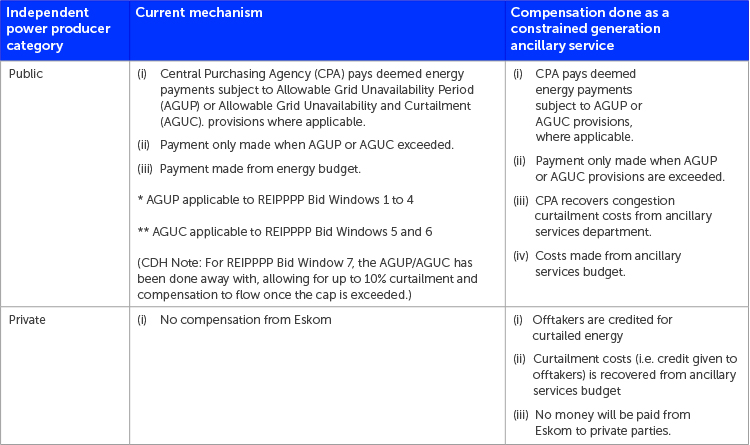

During the Application’s public consultation meeting, Eskom highlighted the following differences in the proposed compensation mechanisms for public and private projects:

The intention is to socialise the costs that underpin the ancillary services budget, seeing that all generators and loads connected to the grid will theoretically benefit from the implementation of curtailment.

While the above is a step in the right direction, the contractual nuances of impacted bilateral projects will still need to be carefully scrutinised on a case-by-case basis, as congestion curtailment cannot be implemented with disregard to the contractual terms that have already been agreed to under existing PPAs, despite the mechanics of the accounting arguably placing the offtaker and independent power producer in the same position financially. In this regard, one of the material considerations will be whether approval of the Application constitutes a change in law, thus allowing for the renegotiation and potential amendment of the applicable terms, provided any agreed materiality thresholds are met.

Conclusion

The highlighted concerns are by no means exhaustive, as the technical, contractual, legal, and financial implications of congestion curtailment will need to be assessed more closely and against the facts and terms of a particular project.

Industry continues to eagerly await NERSA’s decision on the matter.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe