CDH advises Old Mutual Private Equity in relation to the disposal of its investment in Chill and Inhle Beverages to an Alterra Capital Partners-led consortium

- Home

- Home

- CDH advises Old Mutual Private Equity in relation to the disposal of its investment in Chill and Inhle Beverages to an Alterra Capital Partners-led consortium

CDH advises Old Mutual Private Equity in relation to the disposal of its investment in Chill and Inhle Beverages to an Alterra Capital Partners-led consortium

CDH advises Old Mutual Private Equity in relation to the disposal of its investment in Chill and Inhle Beverages to an Alterra Capital Partners-led consortium

CDH's Corporate & Commercial and Competition Law Practices advised Old Mutual Private Equity in relation to the disposal of its investment in Chill and Inhle Beverages to an Alterra Capital Partners-led consortium. The beverage business' key brands include Fitch & Leeds premium mixers, Score Energy and Chateau Del Rei sparkling wine.

You might also be interested in

13 Aug 2024

by Samantha Kelly

What are your legal obligations for obtaining an Energy Performance Certificate in respect of your property?

In 2020, the Minister of Mineral Resources and Energy published a regulation for the mandatory display and submission of Energy Performance Certificates (EPCs) for certain buildings (Regulations). The Regulations impose obligations on owners of specific non-residential buildings to obtain an EPC.

Real Estate Law

2 min read

18 Dec 2024

by Vincent Manko, Jerome Brink and Varusha Moodaley

The South African Business Rescue, restructuring (turnaround) and Liquidation profession is strictly regulated by legislation. Where does tax fit in?

Vincent Manko, Director in the Dispute Resolution practice, Jerome Brink, Director, and Varusha Moodaley, Senior Associate in the Tax & Exchange Control practice joined Jonathan Faurie on the Turnaround Talk on the Front Desk podcast to discuss 'The South African Business Rescue, restructuring (turnaround) and Liquidation profession is strictly regulated by legislation. Where does tax fit in?'

Corporate Debt, Turnaround & Restructuring

23:12 Minutes

14 Oct 2024

by Fiona Leppan, Kgodisho Phashe and Dylan Greenstone

Guidelines released by the Department of Employment and Labour: What every employer and worker should know about workplace safety

On 3 October 2024, the Department of Employment and Labour published a critical guide titled: What every worker and employer should know about health and safety in the workplace . This document outlines the key roles, obligations and rights that both employers and employees must understand to ensure compliance with occupational health and safety (OHS) laws. This guide is an indispensable tool for promoting a safe and compliant workplace.

Employment Law

2 min read

6 Sep 2024

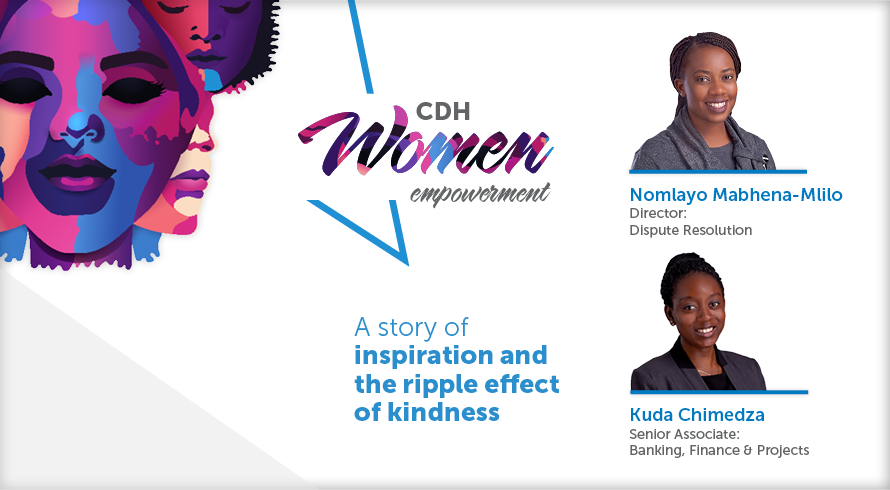

by Nomlayo Mabhena-Mlilo and Kuda Chimedza

A story of inspiration and the ripple effect of kindness

Nomlayo Mabhena-Mlilo, a Director in the Dispute Resolution practice, discusses with Kuda Chimedza, Senior Associate in the Banking, Finance & Projects, how kindness and compassion can shape a legal profession.

Dispute Resolution

17:42 Minutes

25 Jul 2024

by Kgodisho Phashe

Take care before you share: The dangers of social media use in the workplace

Kgodisho Phashe, Senior Associate in the Employment Law practice joined Bridget Masinga on SAFM to talk about Take care before you share: The dangers of social media use in the workplace.

Employment Law

10:47 Minutes

20 Nov 2024

by Arnold Mbeje and Yaniv Kleitman

A stake in your future: Issuances of shares for future consideration

It is common to encounter share subscription transactions where the consideration is payable to the issuer company on a deferred or future date (i.e. “ future consideration ”). However, it is not always easy to spot a scenario where future consideration is at play, often resulting in the relevant provisions of the Companies Act 71 of 2008 (Act) being overlooked. Several interesting issues regarding the interpretation of section 40(5) of the Act arise in thisregard.

Corporate & Commercial Law

5 min read