Kenya Budget Speech

While highlighting the country’s revenue-raising measures for the fiscal year (FY) 2024 to 25, the budget statement reaffirmed the Government’s priority and strategy towards the achievement of the Bottom-Up Economic Transformation Agenda (BETA) which is deemed to be the key to economic transformation and the improvement of livelihoods.

This year’s budget statement was developed against the backdrop of two key issues: national debt and taxes. More specifically, through the budget, the Government seeks to address the question of demands for increased expenditure, translating into the need for higher taxes or more debt; public debt accumulation over the last decade; and the limitations and challenges faced by the Government in mobilising higher tax revenues.

ECONOMIC GROWTH

The FY 2024/25 budget has also been developed against a backdrop of an improved global economic outlook. Growth of the world’s economy stood at 3,2% in 2023 and is projected to continue at the same pace in 2024.

Locally, purposed intervention and structural reforms have steered economic recovery, which is now evident with a real gross domestic product (GDP) growth of 5,6% in 2023, up from 4,9% in 2022, well above the world and sub-Sahara African region’s averages.

Inflation outlook

The macroeconomic environment remains stable with inflation rates of 5% and 5,1% in April and May 2024, respectively. This is after a steady decline from the inflation rate of 9,6% in October 2022.

Kenya’s overall market perception and stability in the foreign exchange market have significantly improved following the February 2024 buyback of the USD 1,5 billion Eurobond and the issuance of an eight-and-a-half-year infrastructure bond. As a result, there has been significant local and foreign investment in the Nairobi Securities Exchange, causing the Kenya shilling to appreciate by a significant rate of 18,7%, having gone down to KES 130,2 as of 31 May 2024. This has also fostered confidence and triggered additional inflows of foreign direct investment.

Expected growth

In light of the on-going reforms and measures proposed, it is projected that the economy will grow by 5,5% in 2024 and 2025 with accelerated investments in:

- human capital development and capital accumulation;

- market development, protection and regulation;

- domestic resource mobilisation;

- reforming and restructuring of government institutions; and

- digitisation to usher an era of efficiency in economic management to support economic recovery.

REVENUE AND EXPENDITURE PROJECTIONS

For the fiscal year 2024/25, total revenue collection is projected at KES 3,3 trillion (18,5% of GDP). This comprises of:

- ordinary revenue of KES 2,9 trillion (16,2% of GDP);

- ministerial Appropriation-in-Aid of KES 426 billion; and

- grants to the budget are expected to amount to KES 51,8 billion (0,3% of GDP).

- Further, the total expenditure for the same period is projected at KES 3,9 trillion (22,1% of GDP). This comprises of:

- recurrent expenditures at KES 2,8 trillion (15,7% of GDP);

- development expenditures, at KES 707,4 billion (3,9% of GDP); and

- allocation to County Governments at KES 444,5 billion, with equitable share at KES 400,1 billion.

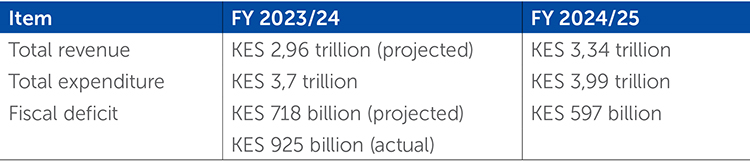

From these projections, there will be a fiscal deficit of around KES 600 billion, or approximately 3,3% of GDP, being the amount by which the projected expenditure will exceed the projected revenue collections. As a percentage of GDP, this projected fiscal deficit is a reflection of the Government’s efforts to rationalise expenditures and shore up revenue collection, which has seen the fiscal deficit gradually decrease from a high of 8,2% of GDP in FY 2020/21 to 5,7% of GDP in the current fiscal year.

Fiscal policy

The primary focus of the fiscal policy is on the reduction of the budget deficit from 5,7% of GDP in the current fiscal year to 3,3% of GDP in the next fiscal year (2024/25). Notably, this will be achieved through enhancing domestic revenue mobilisation aimed at increasing the tax-to-GDP ratio from 11,5% to 25%; and improving efficiency of public expenditure.

Fiscal balance

The fiscal deficit, including grants, is projected at KES 597 billion (3,3% of GDP), down from KES 925 billion (5,7% of GDP) in FY 2023/24.

The fiscal deficit for FY 2024/25 will be financed by net external borrowing of KES 333.8 billion (1,8% of GDP) and net domestic borrowing of KES 263,2 billion (1,5% of GDP). This inclination towards external borrowing as opposed to domestic borrowing may impact the country in the following ways:

- Interest rates: The country can lose out through high interest rates and costs, as external borrowing can be more expensive compared to domestic borrowing.

- Exchange rate risk: If the Kenyan shilling depreciates against the currency in which the borrowing is denominated, the cost of servicing this debt in local currency terms will increase. This could potentially strain the government’s budget if exchange rate movements are unfavourable.

- Macroeconomic stability: Having high external borrowing can expose the economy to external shocks and vulnerabilities. i.e. changes in global financial conditions or sudden shifts in investor sentiment towards emerging markets.

Comparison of budget estimates for FY 2023/24 and FY 2024/25 (KES)

The above projections show an ambitious target to reduce the fiscal deficit by close to KES 400 billion. In our view, this expected drop in fiscal deficit can be addressed by:

- Increasing revenue: Enhancing revenue generation through efficient tax collection, broadening the tax base, and minimising tax evasion can help reduce the fiscal deficit.

- Controlling government spending: Implementing fiscal discipline by controlling government expenditures is crucial in addressing fiscal deficit. This can be achieved through prudent budgeting, prioritising expenditures, reducing non-essential spending, and enhancing efficiency in public sector operations.

- Public finance reforms: Undertaking structural reforms in public finance management, such as improving budget transparency, accountability and governance, can help in better fiscal management and reduction of wasteful expenditures.

- Promote economic growth: Stimulating economic growth through investment in infrastructure, promoting private sector development and creating a conducive business environment can enhance revenue collection and reduce the need for excessive borrowing.

- Debt restructuring and management: Exploring options for debt restructuring, renegotiation of terms with creditors and prudent debt management practices can alleviate fiscal pressures and improve the fiscal deficit situation over the medium to long term.

MONETARY POLICY

The Central Bank of Kenya (CBK) has implemented the following steps to enhance monetary policy transmission:

- adoption of a new monetary policy implementation framework based on inflation targeting; and

- launch of the DhowCSD, a Central Securities Depository infrastructure that delivers registry, custodial and settlement services for both primary and secondary market operations.

POLICY PRIORITIES AND STRUCTURAL REFORMS

The Government aims to strengthen economic recovery by accelerating the implementation of the policies, programmes, projects and interventions in the BETA. The strategic interventions suggested to support economic transformation within the budget include:

- maintaining macroeconomic stability and enhancing security to foster a secure and conducive business environment for Kenyans and their properties;

- scaling up the development of critical infrastructure to reduce the cost of doing business and ease the movement of people and goods, as well as to promote competitiveness;

- enhancing investment in key economic sectors by promoting agricultural transformation, growth in manufacturing, environmental conservation and climate change mitigation, stimulating growth in tourism, and sustainable land use and management;

- enhancing human capital development through investment in health, education and appropriate social safety nets;

- supporting the youth, women and persons living with disability through government-funded empowerment programmes;

- supporting County Governments through the transfer of shareable revenues to strengthen their systems and capacity in service delivery; and

- implementing various policy, legal and institutional reforms to enhance efficiency in public service delivery.

Climate change mitigation and adaptation

Key among the policy priorities in the budget is climate change mitigation and adaptation. The Government plans to formulate and implement long-term climate change mitigation and adaptation strategies, to generate strong resilience pathways.

LEGAL, POLICY AND INSTITUTIONAL REFORMS

The budget also proposes the following interventions to improve the business environment, increase efficiency in public service delivery, and strengthen accountability and transparency in public finance management:

Public procurement

In the last budget, the Government stated its intention to roll out an end-to-end e-Government Procurement system (e-GP) to both the National and County Governments. The system is expected to reduce the cost of goods, works and services by between 10% and 15%, maximize value for money and increase transparency in procurement.

Public sector wage bill

The Government recognises the continued rise of the public wage bill and now intends to among other things, implement the following measures in an effort to contain it:

- Roll out of the Unified Human Resource Information System for the entire public service, starting on 1 July 2024.

- The Salaries and Remuneration Commission (SRC) will continue streamlining allowances and benefits paid in the public service through harmonisation and rationalisation of the categories, rates, and rules for allowances.

- The SRC will progressively review allowances and benefits in future collective bargaining agreements and align them to the provisions of the Allowances Policy Framework for the public service.

State corporations

In order to address the challenges faced by state corporations, the Government intends to privatise government-owned enterprises whose mandates are no longer relevant, those that require huge budgetary allocations for bail outs, and those producing goods and services that would more efficiently be produced by the private sector. The restructuring of state corporations is also proposed, through mergers or transfers back to relevant parent state corporations to remove duplication, enhance efficiency and improve the quality of service.

Pending bills

The Government acknowledges the existence of pending bills and highlights the progress that has been made in addressing the issue. The Pending Bills Verification Committee is continuing with its task of analysing pending bills for settlement, and it is expected to complete its work and submit a report by October 2024 for implementation within the fiscal framework.

National assets and inventory management reforms

Efforts are underway to automate assets and inventory management in ministries, departments and agencies (MDAs) as well as County Governments. National Treasury intends to operationalise assets and inventory management modules in the Integrated Financial Management Information System with the module for all MDAs scheduled for launch and go live in July 2024.

Financial sector

The Kenyan banking sector has remained stable and resilient, with a growth of 0,3% in assets from KES 7,72 trillion in February 2023 to KES 7,74 trillion in February 2024. Recent statistics show that the banking sector asset base grew by 15,6% between September 2022 and September 2023, as a result of an increase in loans and advances. With the intended imposition of both excise duty as well as value-added tax (VAT) on the sector, there is a chance that its growth may slow down further as people will shy away from utilising financial services.

Additional lending to the micro, small and medium enterprises (MSMEs) sector has also been witnessed with the Financial Inclusion Fund (Hustler Fund) and the de-risking of lending to the MSMEs through the credit guarantee scheme. The key interventions that have been implemented to position the banking sector to effectively play its role in Kenya’s socio-economic transformation are:

- licensing and oversight of digital credit providers;

- issuance of the draft Kenya Green Finance Taxonomy to serve as a tool to classify whether particular economic activities are ‘green’ or environmentally sustainable; and

- revision of the Anti-Money Laundering and Combating the Financing of Terrorism and Proliferation Financing supervisory framework.

Notably, the CBK also intends to progressively increase the minimum core capital for banks from the current KES 1 billion to KES 10 billion and amend the Banking Act to provide for stiff dissuasive penalties that are proportionate to the violations committed, support a strong compliance culture in banks, and align to international best practices.

Capital markets

In a bid to better the coffee sector, the Capital Markets Authority has licensed 14 coffee brokers.

The Capital Markets Authority has also approved the direct settlement system which has been operationalised by one of the local commercial banks.

Pension reforms

The Government recognises that a majority of Kenyans remain uncovered, with the retirement benefits coverage at about 26%. It has hence initiated the review and harmonisation of all laws governing the retirement benefits sector in order to effectively implement the National Retirement Benefits Policy, 2023. The budget also suggests a revamp of the public service pension administration through digitisation.

Importantly, National Treasury has established the Kenya National Entrepreneurs Savings Trust to handle pensions from the informal sector and anchor the savings component of the Hustler Fund while providing a channel for voluntary savings.

Insurance

The Government has developed the National Insurance Policy to guide the review of the Insurance Act that has been in place for the last 30 years. The Insurance Professionals Bill, 2024, currently under consideration by the National Assembly, will also strengthen the standards of practice in insurance and improve the stability and performance of insurance companies.

OTHER NOTABLE REFORMS

Public-private partnerships

In recognition of the limited fiscal space, the Government will continue to scale up the use of public-private partnership (PPP) financing for commercially viable projects. In order to enhance viability of PPP projects, the Public Finance Management Act, 2012 will be amended to speed up the process of financial close as well as to ensure that PPP-related fiscal costs and contingent liabilities are within acceptable levels.

Treasury Single Account

To improve public cash management, the Treasury Single Account (TSA) system will be implemented in a clustered approach. The TSA system will consolidate government cash resources into a single account held at the CBK and sub-Treasury Single Account at the commercial banks. Migration to the TSA is expected to commence on 1 July 2024.

Improving the efficiency of public expenditure

The Government recognises the need for an efficient and effective use of public resources. To move towards a balanced budget and further improve efficiency in public spending, the following actions have been proposed for FY 2024/25:

- rationalisation of transfers to semi-autonomous government agencies by at least 30% from the FY 2023/24 approved budget;

- curtailing spending on items such as foreign travel, training across government, allocations for purchase of motor vehicles and furniture, and refurbishments and partitioning of government offices;

- adoption of expenditure control measures, such as suspension of all new recruitment for the next year, an audit and a cleanse of all public payrolls, pensions and transfers to the vulnerable, elimination of ghost workers, enforcement of payment of salary scales as approved or recommended by the SRC, and consolidation of public procurement for common user items;

- utilisation of technology to minimise government expenditure;

- review of insurance schemes under the Universal Health Coverage and aligning them to the Social Health Insurance Fund; and

- review of the Regional Development Authorities to remove duplication of roles with those of County Governments and MDAs.

TAXATION MEASURES

The objective of the reforms is to establish a comprehensive tax policy capable of generating sufficient revenue to finance both recurrent and development budgets. The Government aims to achieve this objective by pursuing the following measures:

- Expanding the tax base

- Minimising tax expenditures

- Creating a predictable tax system

- Developing a tax system that supports markets, production, consumption and investments

FY 2024/25 marks the initiation of these reforms through proposed amendments in various tax laws. These reforms are anticipated to generate an additional KES 346,7 billion (1,9% of GDP). It is noteworthy that this figure is still not enough to cover the projected fiscal deficit, which is at KES 597 billion, meaning that the Government is banking on existing tax measures, including those introduced by the Finance Act, 2023, to bridge the deficit gap.

The tax reforms for FY 2024/25 are as follows:

Custom duties

- Duty remission for raw materials and inputs used by local manufacturers to facilitate East African Community (EAC) domestic production.

- Extension of the current stay of application to import rice and wheat at a lower duty rate.

- Duty remission on inputs for manufacture and assembly of smart tele communication devices.

- Stay of application of the EAC Common External Tariff rate to apply a duty rate of 25% for prime movers and 35% for trailers for one year.

- Duty remission on importation of raw materials for the manufacture of parts used in the assembly of motorcycles.

- Retention of duty rates for iron and steel products for a year.

- Higher duty rate of 35% to ensure the competitiveness of the local textile industry.

- Extension of duty-free importation of inputs for manufacturers of animal feeds.

- A stay of application of import duty on imported leather bags at 35%.

- Income Tax Act

- Exemption of all retirement benefits paid on the earlier of retirement or 20 years after joining a pension fund.

- Increase in annual pension contribution limit exempt from tax to KES 360,000 per annum.

- Removal of withholding tax threshold for management, professional, training and contractual fees.

- Introduction of the minimum top-up tax for multinational groups.

- Telecommunications spectrum licenses fees to be deductible over a period of 10 years.

- Empowerment for advance pricing agreements between the Commissioner and the taxpayers.

- Reduction in capital gains tax rate for firms certified by the Nairobi International Financial Centre Authority.

- Exclusion from capital gains tax from a transfer to an entity, where the individual holds more than 100% shareholding.

- Replacement of digital service tax with significant economic presence tax.

- Introduction of annual motor vehicle tax at a rate of 2,5% of the value of the vehicle subject to a minimum of KES 5,000 per annum.

- Review of subsistence allowance threshold to an amount not exceeding 5% of the employee’s monthly gross earnings.

- Deductibility of Affordable Housing Levy.

- Increase in Mortgage Relief Limit to KES 360,000 per annum.

- Value Added Tax Act and schedules

- Increase in VAT registration threshold to KES 8 million.

- Removal of input tax threshold where the proportion of exempt supplies is less than 10%.

- VAT exemptions for mosquito repellents and their raw materials.

- Rationalization of VAT incentives on the following basis:

- All finished goods currently exempt be subjected to VAT.

- Zero-rated finished goods and services be exempt.

- Zero rating be restricted to goods and taxable services meant for export.

Excise Duty Act

- Change in due date for payment of excise duty on alcoholic beverages to within five working days after removal from the stockroom.

- Introduction of excise duty on imported motorcycles at 10% in addition to the specific excise duty rate of KES 12,952.83 per unit, whichever is higher.

- Increase in excise duty on betting and gaming activities to 20%.

- Review of excise duty structure on alcoholic beverages to be based on alcohol content.

- Review of the excise duty structure on cigarettes.

- Increase in excise duty on nicotine products and nicotine substitutes.

- Taxation of excisable services offered by non-residents through a digital platform.

- Expansion of excise duty to advertisement fees charged on internet and social media.

- Streamlining of excise license issuance to within 14 working days upon receipt of all required valid documents by the Commissioner.

- Removal of excise duty on certain imported goods from EAC states such as eggs, potatoes and onions.

- Retention of 15% excise duty rate on money transfer services.

Tax Procedures Act

- Validity period for agency notices be capped at one year.

- Removal of withholding VAT exemption for some manufacturers whose value of investment in the preceding three years is at least KES 3 billion.

- Enforcement and collection of taxes be undertaken where a decision of the tribunal or court is not stayed and is in favour of the Commissioner.

- Extension of timeline to 90 days for the Commissioner to make an objection decision.

- Miscellaneous Fees and Levies Act

- Reduction of the rate of export and investment promotion levy to 3% for most of the items, and 10% for others.

- Exemption of the National Intelligence Service from payment of the import declaration fee and railway development levy on security equipment and motor vehicles imported or purchased locally for official use.

- Introduction of an eco levy to be payable on specific items.

The report of the Departmental Committee on Finance and National Planning

The National Assembly’s Departmental Committee on Finance and National Planning (Committee) finalised its consideration of the comments received from different stakeholders during public participation and tabled it before the National Assembly on 18 June 2024.

We have noted the Committee’s proposed changes to the taxation measures in the Finance Bill, 2024 and the budget speech, which include the proposals to:

- delete reference to software distribution in the proposed definition of “royalty”;

- delete the proposed change in the preferential tax treatment of reimbursements made to public officers;

- revise the rate of deemed taxable profit for significant economic presence tax purposes from 20% to 10% of gross turnover;

- delete the proposed motor vehicle tax;

- retain the tax-exempt status of registered trust schemes;

- delete the proposal to tax family trusts;

- drop the proposal to standard rate bread;

- retain the zero-rated status of transportation of sugarcane from farms to milling factories, and locally assembled and manufactured mobile phones;

- zero-rate locally manufactured or assembled electric buses and motorcycles, and exempt those that are imported;

- retain the excise duty offset mechanism for local manufacturers;

- extend the deadline for payment of excise duty by manufacturers of alcoholic beverages to the fifth day of every month;

- maintain the prevailing rate of excise duty on telephone and internet data services and money transfer services;

- delete the proposal to impose excise duty on vegetable oil;

- alter the eco levy to apply to only imported items, and removal of the eco levy from application to diapers, motorcycle tyres, bicycles, wheelchairs, and three-wheeled motorized vehicles and plastic packaging material;

- exempt subsistence farmers and microenterprises whose gross turnover is below KES 1 million from electronic tax invoice (eTIMS) requirements;

- amend the proposal to require taxpayers to integrate with the data management and reporting system (DMRS) by providing for a notice period of 1 year and to also exclude entities with a turnover of less than KES 8 million from this requirement. The applicable penalty of KES 2 million to also be reviewed;

- drop or review the proposal to exempt the processing of personal data for tax collection from the provisions of the Data Protection Act; and

- increase the road maintenance levy (RML) from KES 18 per litre to KES 25 per litre of petroleum products.

CONCLUSION

Following the presentation of the 2024/25 budget by the Cabinet Secretary for National Treasury and Planning in Parliament, the next procedural step involves the consideration of both the budget estimates, which will be reduced into an Appropriations Bill, as well as the taxation measures proposed in the Finance Bill, 2024, by Parliament. We expect this to happen within one week, following which Parliament will vote to either accept or reject the estimates and taxation measures. Consequently, the approved Appropriations Bill and Finance Bill, 2024 will be forwarded to the President and be assented into law by 30 June 2024.

It is important to note that the Government intends to implement the various tax measures outlined in the Finance Bill, 2024 in phases. Some provisions will come into effect on 1 July 2024, others on 1 September 2024, and additional measures on 1 January 2025. We will continue to closely follow these developments and prepare a detailed analysis of the final provisions included in the Finance Act, 2024.

In the interim, we encourage you to review the following resources:

- CDH Kenya’s analysis of the Finance Bill, 2024

- The Budget Statement

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe