Customs & Excise Highlights

- Amendments to Rules to the Customs & Excise Act No. 91 of 1964 (Act) (certain sections quoted from the SARS website):

1.1 Amendment to Rule 8 to the Act in relation to part-shipments.

1.2 Draft rule amendment – insertion of Rules. The insertion of draft rule 107A aims to ensure control of the supply chain in the tobacco industry. The rule provides requirements in respect of tobacco leaf threshers. Tobacco leaf threshers are required to register their factories with the Commissioner and keep records for purposes of inspection by the Commissioner. Draft forms are also intended to be amended/inserted, as follows:

1.2.1 DA 185: Application form: Registration / licensing of customs and excise clients; and

1.2.2 DA 185.4A1: Application form (client Type 4A17) – Registered leaf threshing factory.

Comments may be submitted to:C&E_legislativecomments@sars.gov.za by 28 June 2019.

- Amendments to Schedules to the Act (certain sections taken from the SARS website):

2.1 Schedule 1 Part 1:

2.1.1 The substitution of tariff headings 8471.30.10, 8471.41.10 and 8471.49.10 to clarify the scope of computers that are subject to payment of ad valorem excise duties (with retrospective effect from 1 April 2019);

2.1.2 The substitution of tariff subheadings 1001.91 and 1001.99 as well as 1101.00.10 and 1101.00.90 to increase the rate of customs duty on wheat and wheaten flour from 49,07c/kg and 73,61c/kg to 67,51c/kg and 101,26c/kg respectively, in terms of the existing variable tariff formula; and

2.1.3 The deletion of tariff heading 6210.10.20 and the insertion of tariff heading 6210.10.50 in order to review the description from “disposable panties” to “disposable underwear” as well as increase the rate of customs duty from free to 40%;

2.2 Schedule 1 Part 2B:

2.2.1 The substitution of tariff items 124.11.01, 124.11.05 and 124.11.09 to clarify the scope of computers that are subject to payment of ad valorem excise duties (with retrospective effect from 1 April 2019);

2.3 Schedule 1 Part 5A:

2.3.1 To give effect to the budget proposal to implement the carbon fuel tax on fuel as announced by the Minister of Finance on 20 February 2019 (with effect from 5 June 2019);

2.4 Schedule 2:

2.4.1 Subjection of imports from Chinese Taipei (Taiwan) to the payment of safeguard duties on certain flat hot-rolled steel products (with effect from 24 May 2019 up to and including 10 August 2019); and

2.4.2 Amendment of Schedule 2 in order to subject imports from Chinese Taipei (Taiwan) to the payment of safeguard duties on certain flat hot-rolled steel products (with effect from 11 August 2019 up to and including 10 August 2020);

2.5 Schedule 4:

2.5.1 The insertion of rebate items 460.15/7604.29.15/01.08 and 460.15/7604.29.65 in order to create a temporary rebate provision for aluminium bars, rods and profiles for use in the manufacture of stabilisation fins; and

2.6 Schedule 6:

2.6.1 To exclude the carbon fuel tax as announced by the Minister of Finance on 20 February 2019 from the diesel refund scheme (with effect from 5 June 2019).

- SARS issued a media release on 31 May 2019 in relation to trade statistics for April 2019 recording a trade deficit of R3.43 billion. These statistics include trade data with Botswana, Eswatini, Lesotho and Namibia (BELN).

- The International Trade Administration Commission has (certain sections quoted from the notice):

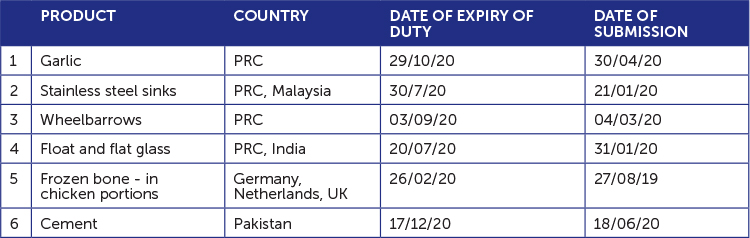

4.1 Issued a notice to the effect that anti-dumping duty on certain products will expire on certain dates. The Commission notified all interested parties that, unless a duly substantiated request is made by or on behalf of the Southern African Customs Union (SACU) industry, indicating that the expiry of the duty would likely to lead to continuation or recurrence of dumping and injury, the following anti-dumping duties will expire during 2020. The due dates for submissions are also provided as follows:

The requests by manufacturers in the SACU of the subject products, and the duly substantiated information indicating what the effect of the expiry of the duties will be, must be submitted in writing to the following addresses:

4.1.1 The Senior Manager: Trade Remedies I International Trade Administration Commission - The DTI Campus, 77 Meintjies Street, Block E – Uuzaji Building, Sunnyside, Pretoria

4.1.2 Private Bag X753, Pretoria, 0001

Manufacturers in the SACU of the subject products listed above, who wish to submit a request for the duty to be reviewed prior to the expiry thereof, are requested to do so not later than close of business on 24 June 2019.

- The National Regulator for Compulsory Specifications has released its “NRCS ONLINE LOA PROCEDURE AND POLICY – 2019”. It includes inter alia administrative procedures, policy documents and fee structures.

- Please advise if additional information is required.

The information and material published on this website is provided for general purposes only and does not constitute legal advice. We make every effort to ensure that the content is updated regularly and to offer the most current and accurate information. Please consult one of our lawyers on any specific legal problem or matter. We accept no responsibility for any loss or damage, whether direct or consequential, which may arise from reliance on the information contained in these pages. Please refer to our full terms and conditions. Copyright © 2025 Cliffe Dekker Hofmeyr. All rights reserved. For permission to reproduce an article or publication, please contact us cliffedekkerhofmeyr@cdhlegal.com.

Subscribe

We support our clients’ strategic and operational needs by offering innovative, integrated and high quality thought leadership. To stay up to date on the latest legal developments that may potentially impact your business, subscribe to our alerts, seminar and webinar invitations.

Subscribe